The Belgium-based circular materials technology company needed more than a traditional insurance policy.

The Belgium-based circular materials technology company needed more than a traditional insurance policy.

Dominik Bark, AIG’s Head of Financial Lines covering EMEA, shares how AIG helps clients position their organizations for long-term growth across the region.

Mohamed Ali Bouabane is leading AIG GCC and North Africa to address the needs of the region’s businesses and insurance market.

Don Bailey, AIG’s Global Head of Distribution and Field Operations, is deepening the insurance organization’s partnership with brokers to help clients succeed in today’s complex marketplace.

The AIG Ambassador discusses key qualities she sees in her allies.

Jill Dixon, AIG Multinational’s Chief Operating Officer, is utilizing data and technologies to help brokers and clients manage risks they may be overlooking.

Inside AIG Programs and how decades long relationships help assure the future at AIG.

Through AIG’s longtime partnership, Move United can help athletes like Josh Elliott rediscover their love of sports.

AIG Global Chief Claims Officer Anthony Vidovich is helping clients and brokers get what they need when it matters most.

Claude Wade, AIG Executive Vice President, Chief Digital Officer, and Global Head of Operations, is leading strategies to reimagine brokers’ and clients’ digital experiences.

As Head of Financial Lines in Sub-Saharan Africa, Roxanne Griffiths supports clients with tailored insurance solutions.

As head of the Accident and Health business covering the Europe, the Middle East, and Africa region, Martin Jorgensen is supporting the health and well-being of the communities AIG serves.

Attracting, developing, and retaining top talent is key.

Benedetta Cossarini is leading innovations that cater to local businesses in Spain.

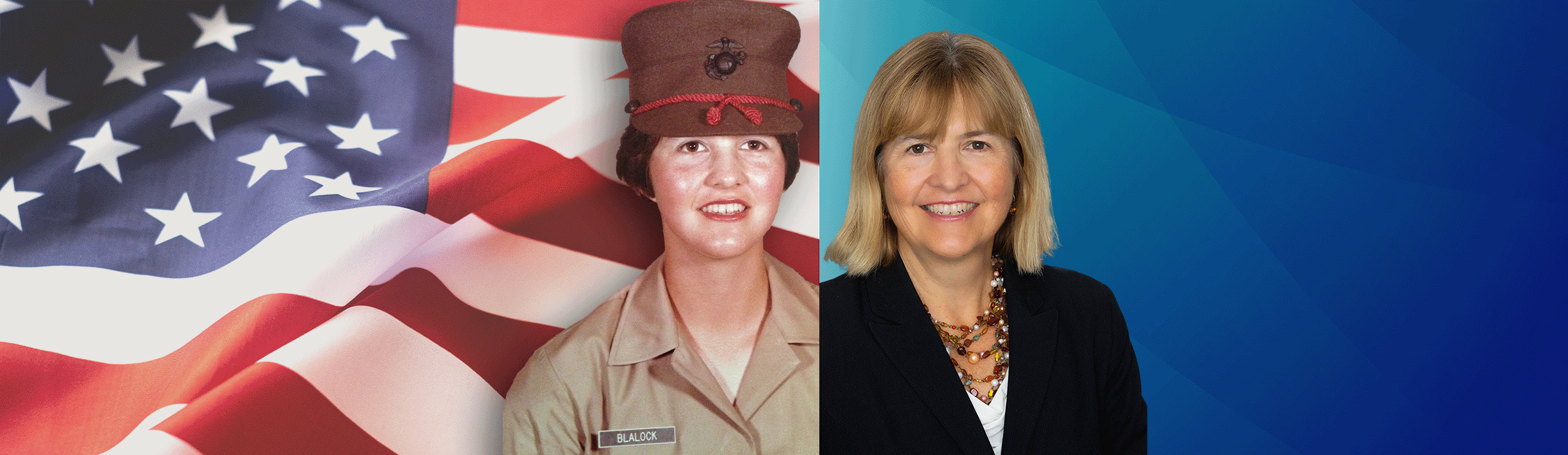

Sharon Primerano’s U.S. Marine Corps Reserve experience shapes the way she leads her team today.

How 21st century exposures shape insurance innovation.

AIG’s Allison Cooper shares why she’s recruiting more women to learn and play golf.

As Head of AIG’s Global Specialty Insurance business, Paul Greensmith is thinking ahead about ways to continually stay relevant to the needs of brokers and clients.

Georgia Hall and Sophia Popov share their advice for future generations of professional golfers.

As Head of AIG Iberia’s Financial Lines, Maria Victoria “Mavi” Valentin-Gamazo is leading efforts to refine AIG’s products and services supporting brokers and clients.

Ellen Robles shares how Employee Resource Groups foster an inclusive environment and help build careers at AIG.